Best 8+ PayPal Alternatives to Use for Your Online Store in 2024

Updated by March 18,2024

PayPal is a payment processing company that allows businesses to accept payments online and offline. It offers a variety of payment options, including credit cards, PayPal, and bank transfers. PayPal also provides features such as fraud protection, automatic payments, and 24/7 customer support.

Apart from PayPal, several other payment processors gained the audience's attention, and it is not surprising that people don't mind using them as well.

Whether it is about small or large businesses, online transactions are the basic need, and if you want to switch from PayPal or try other options, there's no lack of service providers. This write-up will help you explore some best PayPal alternatives, so read on.

Must-Consider PayPal Alternatives in 2024

PayPal is the oldest and the most popular online transaction application that several business owners and individuals have been using. However, if you're looking for the best PayPal alternatives, have a look at the list below.

1. Stripe

Stripe is one of the best PayPal alternatives for eCommerce businesses looking forward to better payment customization methods. This online transaction app comes from the USA and is adept at accepting applications from anywhere in the world.

It also comes with additional features such as advanced reporting, billing, and invoicing tools. Also, you can open a bank account and even incorporate a company in the USA with the help of its Stripe Atlas program.

In addition, you can integrate several web stores and eCommerce stores into Stripe, as you need a plugin for it. However, for every online transaction, Stripe charges 2.9% (of the transaction) and 30 cents. Also, all high-risk industries don't get any support from Stripe.

2. Google Pay

Google Pay is a payment platform developed by Google that allows users to make payments using their mobile phones. The term "Google" in the app gives a feeling of safety and how reliable it can be for online stores in 2024.

It works with various apps and websites, and there are no additional charges for payments made through a debit card. However, if you're using a credit card, you must pay 2.9% of the credit card transaction as a fee.

Google Pay is faster than PayPal and more convenient as it is available on many devices, including smartphones, tablets, and computers. However, several users complain that the app crashes during a transaction, and their data can be hacked if the device is lost.

| Get Started Now to Grow Your Online Business with the Best AliExpress Dropshipping Tool - DSers! |

The countries where Google Pay is currently available include the United States, Australia, Canada, China (including Hong Kong and Macau), France, Germany, India, Italy, Japan, Mexico, New Zealand, Philippines, Russia (including Crimea), Saudi Arabia, South Korea, Spain, Taiwan, Thailand, Turkey, United Kingdom (including Gibraltar), and Uruguay.

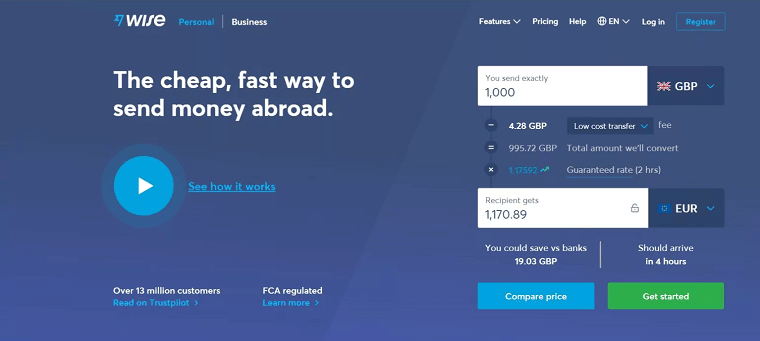

3. Wise

Wise is the perfect choice for individuals and businesses that mostly handle many international transactions. The only thing individuals fear is the transaction fee, and with "Wise," they don't have to worry about it. For example, if a resident of the UK pays $2000 for something with Wise, they'll be paying £106.47 less than with PayPal.

In addition, the users of Wise can get a debit card which allows them to manage transactions in more than 40 currencies. So, if you're a business owner, you can form invoices in the currency of the country in which you're selling.

Finally, if you're interested in knowing how much the transaction fee is, there are no charges for opening an account, but the fee for sending money starts from 0.41%.

4. Skrill

Skrill has been around for the past two decades and can be considered one of the best PayPal alternatives. It offers several online payment and money transfer services to more than 120 countries in 40 currencies. Skrill comes with a virtual wallet which adds the convenience factor to the transactions and makes them secure for the users.

You have to pay $5.5 for every withdrawal, and every credit card transaction costs you about 2.99% as a fee. Skrill also has custom dashboards and reporting, which makes using it very easy.

However, you may need help with its customer support as it is often flooded with queries. And many accounts have been closed without giving any prior information to the user.

5. Payoneer

Payoneer is one of the best PayPal alternatives for small and medium-sized businesses, as it makes transactions quick and secure. It has several similarities to PayPal as it also provides money transfers and digital payment services. Payoneer is a popular alternative, offering many of the same benefits and services with a few key differences.

One of the most significant advantages of Payoneer is its low transaction fees, which are often lower than PayPal's, making it a cost-effective solution for businesses and individuals alike. Payoneer also offers multi-currency support, allowing users to receive payments in different currencies and convert them at competitive exchange rates.

Additionally, Payoneer provides local bank transfer options in over 200 countries, making it easier for users to access their funds. However, its customer support can be a bit slow compared to other options, and an account once lost accidentally, cannot be recovered by any means.

6. Square

You can rely on Square for transactions if you own a small company or work as a freelancer. It is a secure payment app that you can use as a PayPal alternative and offers a variety of payment types, such as key-in, online payments, and invoices as well.

In addition, you can sign a long-term contract with this app, customize the interface, and pay no extra charge for all of these features. The standard processing fee for Square is 2.6% + 10 cents, but it is only applicable for contactless payments, chip cards, swiped, and magstripe. For manual key-in payments, you'll be paying 3.5% + 15 cents.

Square is an excellent PayPal alternative, but with increasing processing fees, it will no longer be an apt application for small businesses. Also, users may find it challenging to switch accounts between locations.

7. Venmo

Venmo is a mobile payment service with more than 60 million users active on it daily. It allows users to easily add a personal touch to the transactions and transfer money. Currently, Venmo is mainly preferred by small businesses and charges lower fees than PayPal.

It is also better than PayPal in terms of effectiveness, as you can transfer funds instantly but have to wait a few days if you're using it. In addition, you can integrate Venmo into other popular apps, such as food delivery and ride-sharing services, enabling users to make payments within those apps.

However, Venmo has some drawbacks too, and the most prominent one is that only the residents of the USA can access it. Also, all payments are made publically, so a question arises of privacy.

8. Authorize.Net

Authorize.Net is a great alternative to PayPal for those looking for a more robust and customizable payment solution. It is a subsidiary of Visa and is known for exceptional customer support. Businesses are getting several benefits from the payment services it offers, like credit and debit cards, electronic checks, and ACH transactions.

It also offers advanced fraud detection and protection features, helping merchants to secure their transactions and reduce the risk of fraud. Authorize.Net integrates with a wide range of e-commerce platforms, making it easy for merchants to accept payments on their websites.

Additionally, Authorize.Net offers 24/7 customer support and a secure and reliable platform, providing merchants with peace of mind and the ability to manage their payments with ease.

Coming to the drawbacks of Authorize.Net, only some individuals can use the app, and its plans start at $25 per month, which makes it a bit more expensive than other options.

9. Remitly

Remitly is a digital money transfer service that offers an alternative to traditional remittances like PayPal. Being a user-friendly platform, users find it very effective in cross-border transactions. It is designed in a way that sends money to friends and family in other countries without burning a hole in the pocket.

Remitly offers competitive exchange rates, low fees, and fast transaction speeds, making it a great alternative to PayPal for international money transfers. It focuses on providing a secure and reliable service that offers peace of mind to the users and the ability to manage international transfers easily.

However, you'll find limited money transactions, and cash pickup is only available in some countries. In addition, even though the customer support is good, users often complain that it needs to be faster.

Final Words

With times changing, people can't stay dependent on PayPal as several other money transaction apps are available. To select one from the list of the best PayPal alternatives, you must understand your business requirements.

With the right choice, you can even improve your business functioning. However, if you would like to read more interesting blogs related to dropshipping and eCommerce, you can read them on the DSers blog page.

Company

Company

Why Choose DSers

Why Choose DSers

Blog

Blog

Help Center

Help Center

Live Chat

Live Chat