What is an eCheck and How Does it Work: Everything You Need to Know

If you are into eCommerce, then you might be familiar with an eCheck, which stands for Electronic Check. It is one of the latest modes of payment that can help you provide a seamless shopping experience to your users.

Since it is a new concept, you might not know much about it. Therefore, in this post, I will let you know what is an eCheck, how it works, and its common benefits.

What Is an eCheck: Covering the Basics

To start with, let’s understand what is an eCheck all about. Electronic checks or eChecks can be considered a modernized rendition of traditional paper checks. The concept follows the Automated Clearing House (ACH) network in which money is directly debited from the payer’s account.

Consider this as an electronic version of a paper check where money is electronically transferred from a payer’s to a seller’s account in a safe and carefully restricted environment. Lately, eChecks have gained a lot of popularity as they are faster, safer, and more convenient to handle. They are also known as direct debits, ACH transfers, or ACH payments these days.

How Does an eCheck Work

Now that you know what is an eCheck, let’s understand how it works. The overall processing of eChecks is quite similar to that of paper checks – but faster. That is, instead of filling out the check and sending it to someone, everything is taken care of by electronic means. Mostly, the processing of an eCheck will undergo the following steps:

Request authorization: This is the first step of processing an eCheck that is initiated by the business. Before making the transaction, the business should access authorization checks from the customer. There are numerous ways to implement this via an online check, signed orders, or even a phone call.

Payment setup: Once the authorization process is completed, the needed information of the customer is sent to the payment processing system. Here, options for one-time or recurring payments can also be opted for.

Final and submit: That’s it! After undergoing a series of security and authorization steps, the transaction is submitted to an ACH system. If all the inputs are matched, it gets accepted and is finalized.

Money deposited: After completing the final stage, the designated amount is deducted from the customer’s bank. Subsequently, funds are deposited to the seller’s account and are reflected in 3-5 business days. The receipt of the payment is shared with the customer and its copy is also maintained by the bank and the seller.

Key Benefits of an eCheck

There are plenty of reasons why eChecks are becoming more and more popular these days. From our explanation of what is an eCheck, you can already understand its benefits. Though, these are some of the major reasons why you can also consider moving to eChecks or including them as a part of your payment modes.

Cheaper: Compared to other options (like credit cards), eChecks are far more budget-friendly. Businesses don’t have to take care of additional processing fees as eChecks follow a direct deposit process.

Diversity: Since electronic checks follow a simple and secure process, you can implement them in multiple ways. For instance, you can use them as payment options for rent, eCommerce platforms, insurance premiums, and so on.

Faster: Again, if we compare eChecks to paper checks, then they can be much faster. The manual process of paper checks can take a lot of time in authorization and processing. On the other hand, eChecks are processed automatically with minimum or no delays at all.

Security: Needless to check, paper checks can easily be compromised or tampered with. This can cause a lot of security concerns and even leads to fraud. Since eChecks are based on a secure ACH network, there are no chances to authorize fake checks. This leads to a safer online payment experience for businesses and customers alike.

Automation: Most importantly, you can automate the overall payment process with eChecks, which is not possible with paper checks. This makes them an ideal option for paying for your subscriptions, insurance premiums, rents, and other regular bills.

Frequently Asked Questions

What details are needed by customers to set up eChecks?

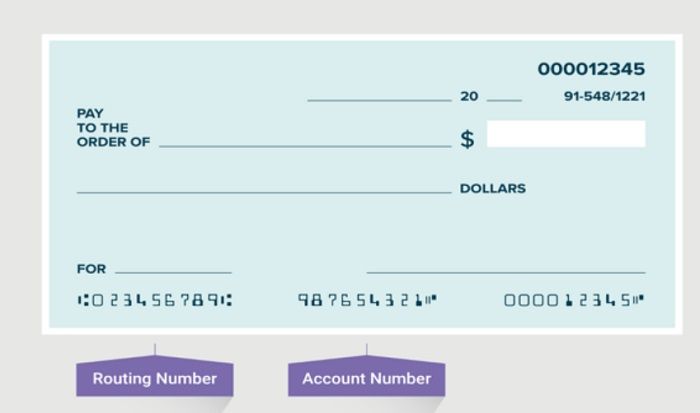

Any user can set up their eCheck by getting their account authorized by their banking or payment system. To do this, they just need to enter their checking account number and the bank routing number. Once the eCheck system is active, they just need to enter the amount to send and authorize the transaction.

How can businesses set up an eCheck system?

Just like customers, businesses can also set up an electronic check system. To do this, they have to register as an authorized merchant on the ACH system. For this, details like the business name, address, transaction processing volumes, bank account details, and federal tax ID numbers are needed. Once the authentication process is completed, businesses can start receiving money from their customers.

What can eCheck payments be used for?

Due to their diverse applications, eCheck payments can be used in different sectors and instances. They can be used to make legal payments or to perform peer-to-peer transactions. They are also ideal for recuring payments of subscription fees, rents, insurance premiums, loan repayments, and so on.

Is an ACH transfer the same as an EFT?

EFT, which stands for Electronic Funds Transfer, is a broader term that can be used for all electronic transfers. This includes direct deposits, wire transfer, and ACH payments. On the other hand, ACH payments rely on a unique Automated Clearing House system, which is a regulated electronic system for payment processing. Therefore, you can say that eCheck is a type of EFT, which is specifically based on the ACH network.

How long does it take to clear an eCheck?

This would depend on the number of working days and the overall authentication process. Mostly, a standard eCheck gets cleared in 24 to 48 hours after initiating the transaction. Though, the deposits are reflected in 3-5 working days after the transaction is initiated and approved.

Is it possible to cancel an eCheck?

Yes – you can cancel an eCheck, but the process would largely depend on the payment system that you are using. If the payment is pending, then you can get in touch with the payment gateway or your bank to cancel it. Though, if the payment has been cleared and deposited to the other account, then it can’t be canceled.

What happens when an eCheck bounces?

Due to the stringent security protocols, the chances of bouncing an eCheck are less. In case the payer doesn’t have enough funds in the account, then it will be bounced. If a check is bounced, then the payer might have to pay a penalty. To avoid that, you must ensure that your bank account has enough funds before authorizing the check.

Explore DSers: Best Dropshipping Solution

While the concept of electronic checks can help you provide a smoother experience to your customers, you need to have the right products in your store to offer. For this, I would recommend using DSers, which is the official AliExpress dropshipping tool.

| Get Started Now to Grow Your Online Business with the Best AliExpress Dropshipping Tool - DSers! |

- DSers will give you access to thousands of sellers worldwide, letting you pick just the perfect products to sell in your store.

- Since it is the official AliExpress dropshipping tool, you can seamlessly integrate it with Shopify, Wix, and WooCommerce.

- You can also use its Supplier Optimizer feature to instantly find the best-rated and profitable supplier for any product.

- DSers will help you keep your customers informed about their orders via its automatic tracking of order statuses.

- There are tons of other advanced features in DSers like variant mapping, stock management, bulk ordering, bundle products, PayPal order tracking, and more.

Conclusion

There you go! I’m sure this in-depth guide would have helped you understand more about eChecks and how they can help you. Apart from covering basics like what is an eCheck, I have also listed its benefits, and tried to answer relevant questions about the concept.

Feel free to explore more about eChecks and also try a tool like DSers to support your dropshipping store. It is the official AliExpress dropshipping tool that supports every leading platform and is equipped with tons of features.

Company

Company

Why Choose DSers

Why Choose DSers

Blog

Blog

Help Center

Help Center

Live Chat

Live Chat