Influence of EU VAT Reform on Dropshipper

The article below is from AliExpress and talks about the EU VAT Reform in AliExpress.

Brief Introduction of New VAT Regulation in the EU

Major Changes:

According to new European Union VAT policy, all e-commerce businesses have to pay product taxes. Effective on July 1st, 2021, the following changes will apply to orders shipped to the EU from outside the EU:

- Removal of the current exemption for imported goods under EUR 22. It means that all goods imported to the EU will be subject to VAT on and after July 1st.

- For goods valued at less than EUR 150, AliExpress will be responsible for collecting VAT from consumers in accordance with EU tax laws and paying VAT to the Customs Office;

- For goods valued above EUR 150, VAT and duties are still levied by the customs at the time of import.

All packages imported to EU countries, or shipped accross borders internally in the EU, have to pay the VAT via IOSS.

AliExpress has completed the IOSS registration and can take care of the customs clearance while helping dropshipping business in paying for tax. This means that all packages are good to go.

Changes of AliExpress Related Rules

To General Customers

- If the goods are shipped directly from outside the EU to EU buyers, and goods are valued at less than EUR 150, VAT will be collected and paid by AliExpress.

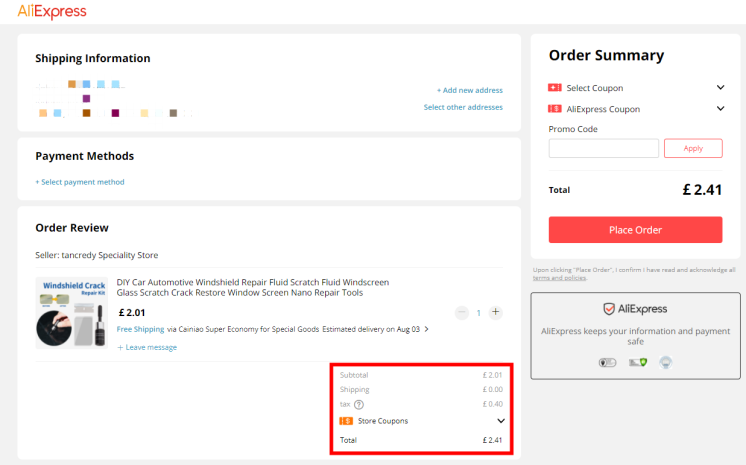

- Buyers can see the specific VAT on the checkout page.

To Dropshippers

Please refer to the following instructions to see what dropshippers should/could do to meet your business requirements:

1. EU VAT will be collected by AliExpress and then paid to the required EU party.

- Dropshipping business can be run normally and the end customers don’t need to pay EU VAT at all.

- Dropshippers don’t have to perform extra operations on AliExpress or on DSers.

- AliExpress will fully take care of customs clearance.

Please see the checkout page on AliExpress below

2. Dropshippers who want to pay tax by themselves

Doubled-tax may occur when Dropshippers pay the VAT in an EU country, while AliExpress collects EU VAT at the same time. You can apply for EU Tax refund with AliExpress.

- AliExpress will collect EU VAT anyways to insure packages customs clearance successfully, and make sure the end-customer won’t need to pay for tax.

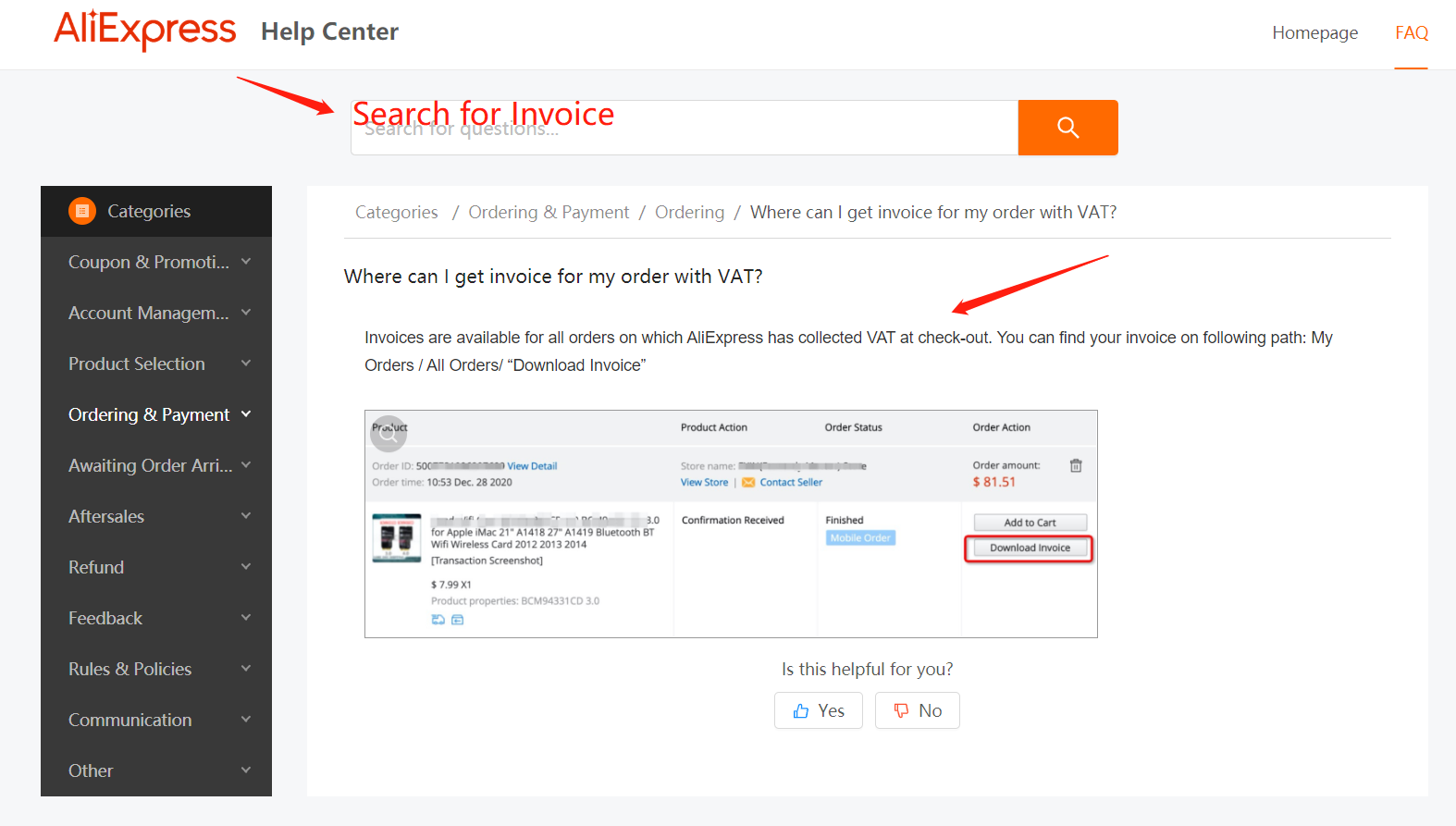

- Contacting AliExpress and filling for tax refund is possible with valid invoices downloaded from AliExpress - My account page.

If Dropshipper prefer to pay VAT, and don’t want AliExpress to collect EU VAT

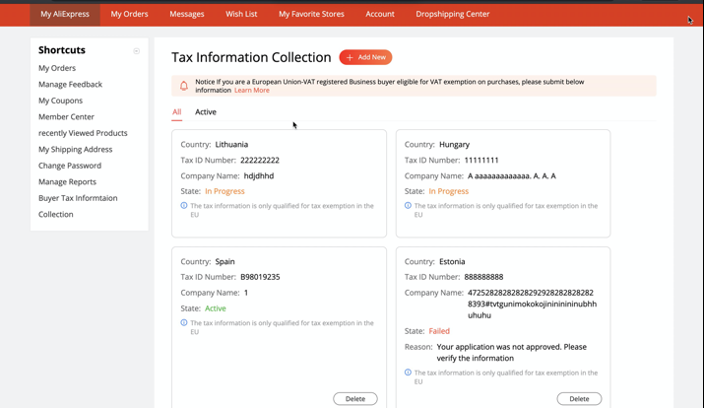

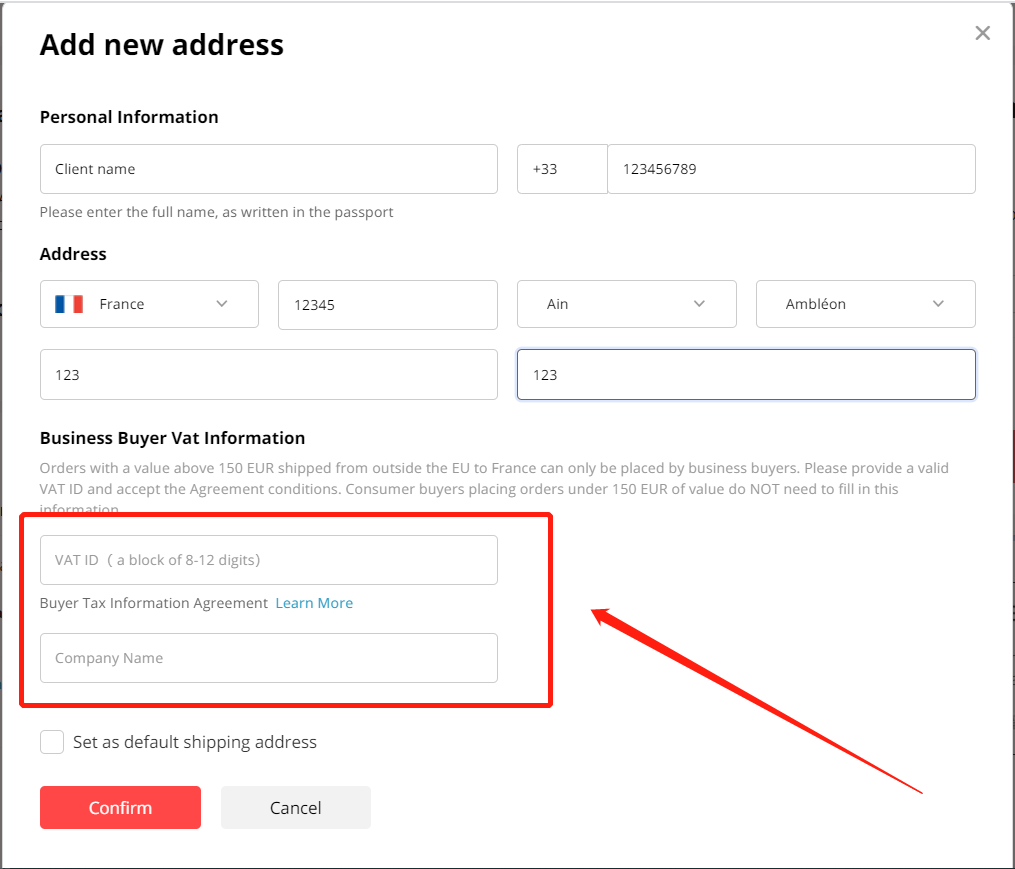

1. Register as a Business Buyer on AliExpress with VAT number and Company name

2. AliExpress will not collect EU VAT, and will NOT help ensure customs clearance.

3. Please contact your suppliers and make sure the suppliers will ensure customs clearance

Business Buyer

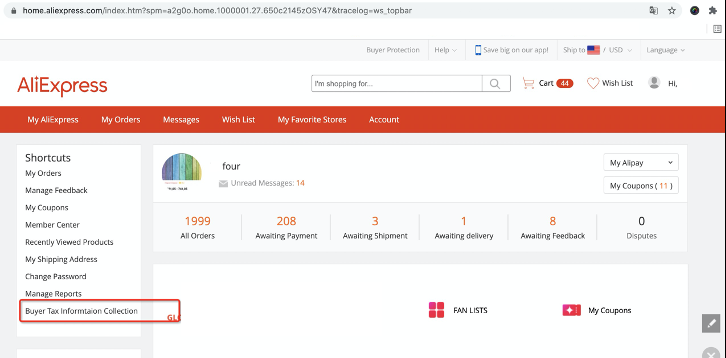

To register as a Business Buyer, you need to submit VAT number and Company name to AliExpress - My account page.

|

Manage Multiple Stores In One Account Multiple Stores Management - Link and manage multiple stores on different platforms in one place |

If the “Buyer Tax Information Collection” tag does not appear, it means the account is not yet activated as a Business Buyer.

When it happens, you can contact the AliExpress Team to activate it.

Special Scenarios:

1. For any single order valued more than 150 EUR

VAT will not be collected by AliExpress. Dropshipper needs to contact the supplier to deal with EU VAT, otherwise the packages may detained by Customs.

2. For any single order with multiple items, valued over 150 EUR, while each item is less than 150 EUR

Please consider splitting the order in your store (Shopify/WooCommerce/Other). Make sure the total value of the single order is less 150 EUR, and then the orders can be processed normally.

3. For French order over 150 EUR

AliExpress is officially developing to adapt to French rules, and you currently cannot place those orders automatically.

Please manually place the orders on AliExpress, and then input VAT number and Company name on AliExpress (VAT shall be paid by the Dropshippers).

4. EORI

It is only for UK orders. AliExpress is still working on processing orders for EORI. DSers will soon apply the integration for Dropshipper.

To summarize, AliExpress will take care of everything about paying the VAT. And you don’t have to take any action to pay the VAT unless you want to do it by yourself or your order is over 150 EUR.

DSers is working hard with AliExpress to adapt to the new EU VAT rules and will make sure to keep you updated on any future changes and facilitate your business!

Company

Company

Why Choose DSers

Why Choose DSers

Blog

Blog

Help Center

Help Center

Live Chat

Live Chat